Table of Contents

A Line of Credit (LOC) is usually preferable to a standard term loan, as it gives you much more flexibility.

But getting a LOC isn’t always easy.

The lender will perform a rigorous review of your credit history, tax returns, and many other business documents, and they’ll also want a projection of your business revenue and expenses, along with an explanation of how exactly the line of credit will be used.

They want to make sure that you can pay them back.

To secure a line of credit, you’ll need to support your business plan with cold, hard data.

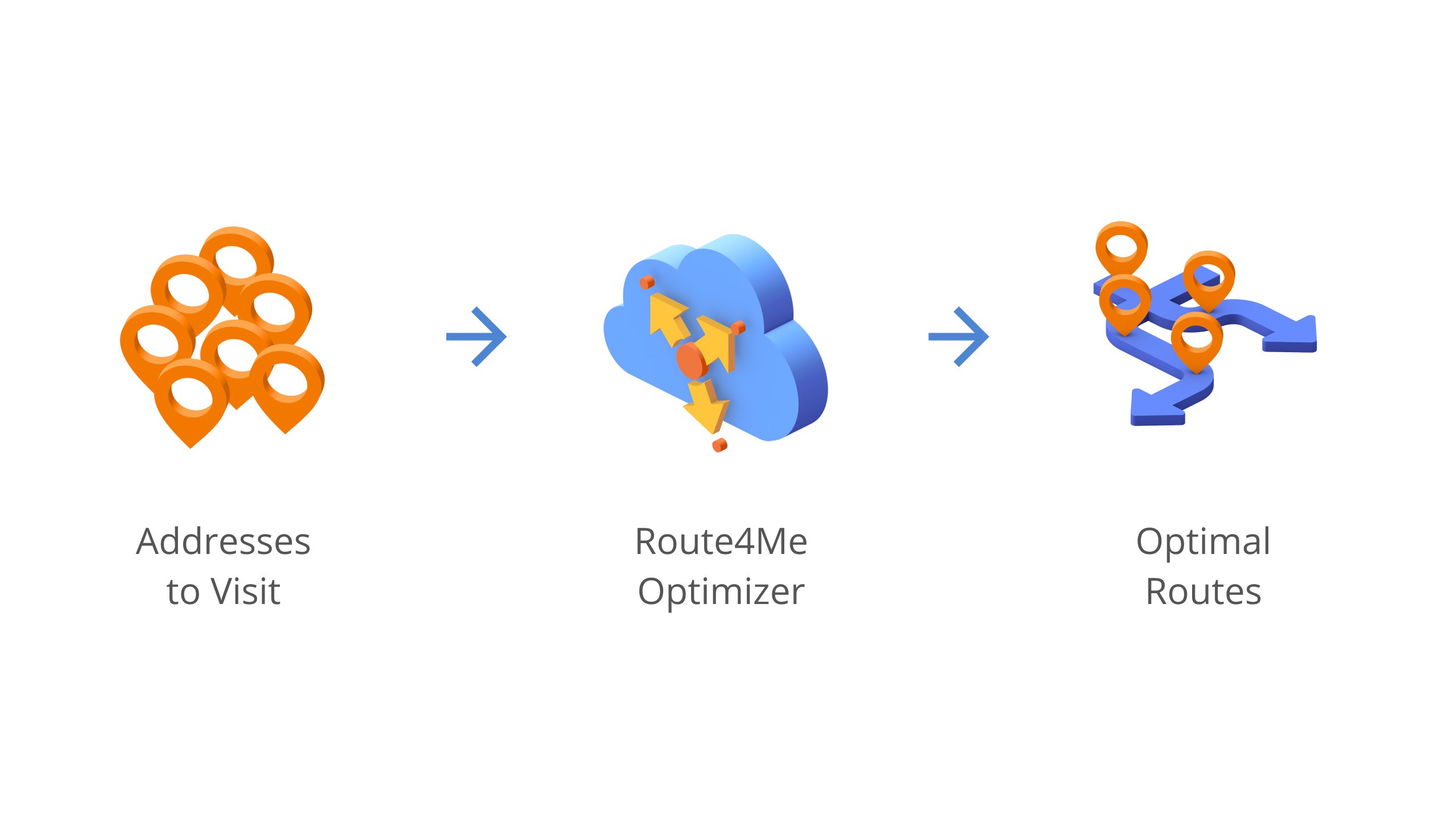

That’s where our route optimization software comes in.

Route4Me route planner will help you source all the sales and operations data you need to convince lenders that your reports and projections are accurate. Read on to learn how:

Learn what route optimization is.

#1 Design a Foolproof Sales Plan

If you’re asking for financial help with an expansion, lenders will take a hard look at whether your business will be able to generate more revenue after you’re given some capital to work with.

How will you prove that you can make more money later if you have a little cash now?

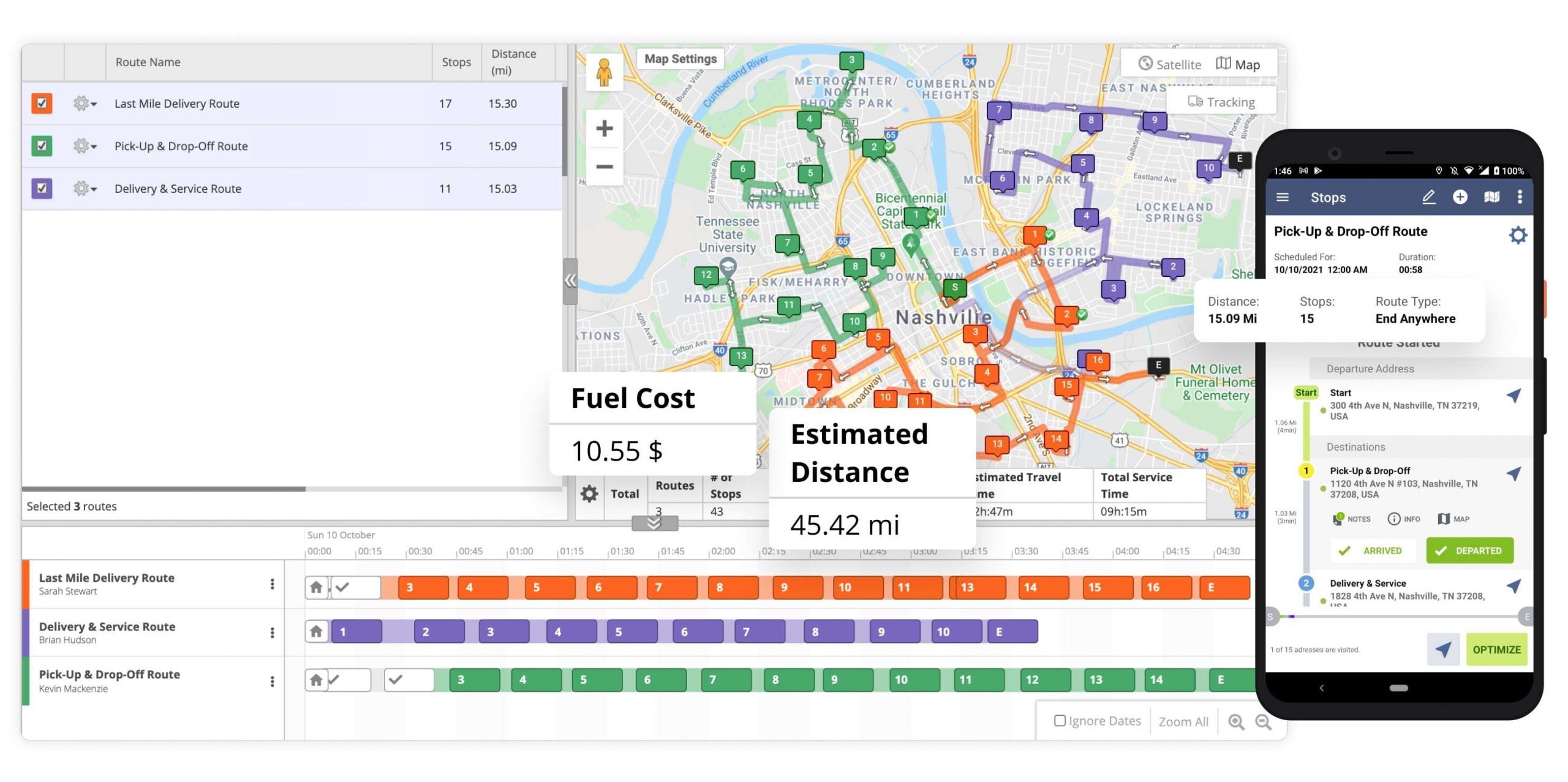

Our multi-stop route planner comes with an interactive map feature, making it easy to see where you’re doing business and where you’re not.

Are you covering every area you could cover?

Or is there a goldmine of nearby communities you could potentially service?

If only you had the money to expand… with our maps, you could prove that these opportunities for new revenue do exist.

You can keep track of which leads are hot and which are cold on Route4Me, and you can create mock routes with real addresses, allowing you to see exactly how much it would cost to expand into new territory.

Want To See For Yourself How Route4Me Can Boost Your Profits?

#2 Make Operations More Efficient

When a lender reviews your finances, the less waste they find, the better.

In most cases, a business has to deal with more expenses as it grows. As your sales increase and you have more customers to visit, you’ll likely need to hire more dispatchers to handle all the extra traffic.

But not necessarily.

By switching to the Route4Me map route planner, you’ll cut the time it takes to plan routes from several hours down to just 30 seconds or less.

You won’t have to hire a new dispatcher to accommodate many new routes, which means you can add profits without any expenses.

You can have your cake and eat it, too.

Learn how to plan a route with multiple stops in 30 seconds.

So you won’t need as many dispatchers, and delivery scheduling software makes the job easier for the dispatchers you do have.

That’s because of GPS tracking. You can see exactly what your drivers are up to in real-time.

How does GPS tracking work?

A commercial GPS tracker helps you visualize your drivers’ activities on a map in real-time so that you can immediately know if a field rep or driver makes an unauthorized stop or takes longer than planned at a specific destination.

Are drivers delivering on time?

Are they taking long breaks?

Is someone broken down in the middle of the street?

You and your managers can get the answers to all of these questions and more with the map inside the GPS tracking app.

Depending on the size of your operation, you might not need any driver management at all once you have Route4Me. Imagine how much money that would save you.

Prevents Driver Fraud

Also, the Route4Me delivery route planner prevents drivers from billing hours they never really worked.

You’ll know where your drivers are at all times, so there’s no way for them to lie to you and get away with it.

Learn in detail how route optimization software can help you prevent driver fraud.

Centralized Transportation Management

Delivery management software offers centralized transportation management as well. This means that you can monitor drivers, plan routes, and access reports all from the same place.

Route4Me is easy to use. It’s fast, too, with 100% accurate routes with directions to work for last-mile drivers produced in just seconds!

#3 Increase Your Profit Margin

Future projections are great, but lenders are also interested in how much you make now.

If other companies in your industry tend to have a profit margin of around 4%, yet you’ve managed to earn a 7% margin, lenders will prefer to fund your business over the others.

A bigger margin makes your business look healthier like you have an easy time paying back people who’ve spotted you some money. Lenders like that.

As previously mentioned, a route planner increases your profit margin by allowing you to add profits without adding expenses.

A trucking GPS app increases your profit margin by making sure your drivers make on-time deliveries every time.

This will make your customers happier, which in turn will lead to your customers remaining loyal and even recommending your service to others.

More loyal customers combined with organic word-of-mouth marketing will, of course, increase your profit margin.

Do you have any questions?

If not, we’ve got one for you – What strategy do you use to secure a line of credit? Let us know the comments below.

Want To See For Yourself How Route4Me Can Boost Your Profits?