You can raise your income by working as a freelancer, food delivery person, or rideshare driver. However, tracking your expense reports, mileage, and export tax file reports can be a hassle.

Thankfully, there are mobile apps that will help you track mileage and expenses. So, what’s the best mileage app for delivery drivers? Let’s find out.

Table of Contents

Top 7 Mileage Apps For Delivery Drivers

1. Everlance

Average Price:

The price depends on your subscription plan. 1 month is roughly $12, and annually is about $118. The business plan is around $120 for 10 employees and up to $500 for 50 employees.

Compatibility: The Everlance mileage tracking app is compatible with iOS, Android, Windows, and MAC via an app installer.

Best For: Everlance tracking feature is best for self-employed and gig workers who need to track expenses and mileage for tax season.

Pros:

- Free expense and mileage tracker

- User-friendly, easy to use

- Intuitive user interface

- It has a 60-day Free Trial

- Easy to export tax report data

Cons:

- Drains phone battery

- Limited free features

2. SherpaShare

Average price:

Subscription fees start at around $59.90 monthly for 10 employees and almost $299.50 for 50.

Compatibility: This miles tracker app is compatible with iOS, Windows, and MAC.

Best For: SherpaShare app is best for a trucking company with multiple vehicles because it has priority support informing the account manager of other drivers’ work locations.

Pros:

- Free 7-day trial

- Unlimited mileage tracking for premium

- Has smart driver tools

- Has a VIP customer support site

- Gather data on profitable routes

Cons:

- Does not support Android

- Doesn’t have a Free Plan

3. Hurdlr

Average price:

The prices depend on subscriptions. For 10 employees, it starts from around $100 to about $500 for 50 employees.

Compatibility: This tracking app is compatible with iOS, Android, Windows, and MAC.

Best For: Hurdlr is best for freelancers because the program can identify accurate results and sync them to the company’s economic environment.

Pros:

- It has a Free Plan

- Automatically detects movement when driving

- The software application is straightforward

- GPS mileage tracking app

- Accurate results and syncing feature

Cons:

- The free version is not good

- Manual turning off of tracker

4. Stride

Average price:

The stride app is a free mileage tracker app. It has a premium plan starts at around $140 per employee per month.

Compatibility: Stride is compatible with iOS and Android via the app installer.

Best For: It is best used by independent contractors and gig companies.

Pros:

- It is a free app

- Monitors taxes to save annually

- Locates money-saving write-offs

- Assist business expenses filing

- Automatically maximize mileage deductions

Cons:

- Manual start and end tracking

- Doesn’t link to motion sensors

5. MileIQ

Average price:

The premium plan includes unlimited mileage tracking for roughly $59.99 annually and $5.99 monthly.

Compatibility: MileIQ can be downloaded on iOS or Android.

Best For: This automatic mileage tracking app is best used by healthcare professionals for tax bill reports.

Pros:

- Automatic motion sensor feature

- The mileage deduction amount is displayed

- Background running for mileage matters

- Unlimited automatic trips for premium

- Allowed to link separates together

Cons:

- Less accurate mileage tracker

- Drains battery

6. Triplog

Average Price:

Premium features access fees start at around $4.99 per month, and the premium plus is roughly $8.33 monthly per user.

Compatibility: Triplog app is compatible with Android, iOS, and PC.

Best For: Mileage is best for an independent contractor with multiple jobs because it is also an expense-tracking app.

Pros:

- Offers GPS tracking

- Expense tracking and managing timesheets,

- Helps users obtain tax breaks

- Additional tax compliance reports

- Link to third-party apps

Cons:

- Not user-friendly interface

- Hard integrated accounting system

7. QuickBooks Self Employed

Average Pricing:

The Elite Plan costs about $140 for 10 employees and $540 for 50 employees monthly. [2]

Compatibility: Compatible with Android, iOS, and PC.

Best For: Best to use by self-employed or freelance delivery drivers because it helps categorize personal and business transactions for IRS filings. [3]

Pros:

- Helps classify IRS filing categories

- Bookkeeping with mileage tracking

- Accurate mileage data

- Doesn’t drain the battery

- User-friendly interface

Cons:

- Additional fees for tax filings

- Expensive plans than other apps

What’s A Mileage Tracking App?

A mileage tracker app is a mobile app with tracking features that help maintain a log of your travel distances for a tax deduction or reimbursement.

Therefore, every mile you travel to meet clients, conduct errands for your business, or pick up supplies will add up to one thing: money, which will either be taken out of your taxes or reimbursed after you file.

How Does It Work?

Since mileage tracker apps must be installed on your mobile device before use, every app works after you sign up and subscribe to their plan. There are free mileage trackers, but getting a plan works best to take full advantage of the service.

GPS Mileage tracking apps track mileage and start recording as soon as you drive. It collects your expenses for profit charting and files them for annual tax filing.

Should Delivery Drivers Use A Mileage Tracking App?

A delivery driver should use a mileage application to track miles to their delivery work. Tracking the miles of a food delivery driver every day and being able to deduct business mileage on his tax calculations summary is a big help to save money.

The best mileage tracker apps also serve as expense tracking apps for drivers whenever there’s an additional expense on their delivery service.

Why Is It Important To Track Miles?

Tracking mileage is vital for tax deductions. A mileage tracker app is essential for personal and business trips, as it captures, reimburses, and reports on your employees’ business miles.

If used effectively, mileage logs clearly represent personal and business usage. An accurate and compliant mileage log is best in the event of an audit.

Things To Consider When Choosing The Best Mileage App

- Consider what mileage features you need. Do you need an automatic tracking mileage app, or are you okay with manual mileage tracking of your data?

- Take note of how much money you will spend on a mileage tracker. There’s a free version available, but it may not have all the features you need.

- Read reviews of various tracking apps before choosing the best mileage tracker. This will help you better measure which is the best for you.

Why It’s Important To Use A Circuit Route Planner

User-Friendly Interface

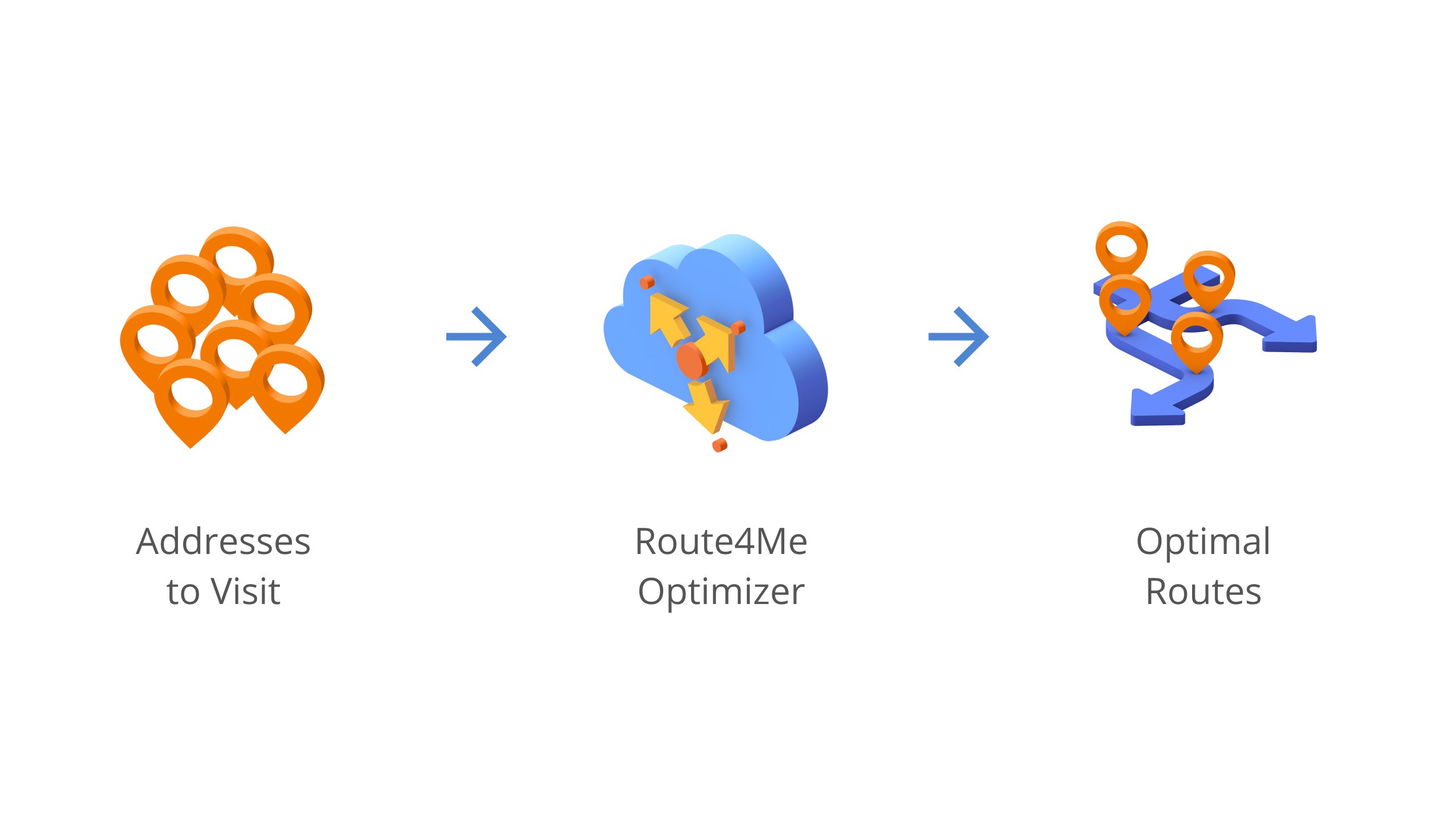

A user-friendly smartphone application like Route4Me that can significantly benefit your delivery business can be taught to your delivery drivers. The app offers a user-friendly interface to explore the many functions and is available in iOS and Android versions.

Multi-Stop Route Planner App

Improves Calculations

The multi-stop route planner app helps drivers get accurate mileage calculations for tax compliance reporting and mileage deductions.

Helps Dispatch The Multi-Stop Deliveries

You can dispatch the multi-stop deliveries to your drivers based on their availability and schedule using the software’s analysis of real-time traffic and weather updates. To save time and effort and increase corporate efficiency.

Has Digital Proof Of Delivery

Having evidence can limit your liability and answer any queries the client may have. Apps like Route4Me route planner provide digital proof of delivery. This includes a snap photo of the delivered package or a picture of the customer’s digital signature.

Frequently Asked Questions (FAQs) about Mileage Tracking Apps

Does Google Maps have a mileage tracker for drivers?

Do all delivery apps allow the use of a mileage app for drivers?

Conclusion about Mileage Tracker Apps

We conclude that the best mileage tracker app is Everlance. It offers unlimited trips in cheaper premium plans with ample data storage of income tracking and unlimited manual tracking of expense categories.

The app allows the manager to add trips or edit data vital to tracking miles.

Everlance is a simple mileage tracker app that stood out among the best for its easy-to-export tax data features that could help delivery drivers and gig workers deduct mileage for tax filing.

Multi-Stop Route Planner App

References:

https://www.forbes.com/advisor/business/software/best-mileage-tracker-app/

https://quickbooks.intuit.com/self-employed/

https://www.irs.gov/tax-professionals/standard-mileage-rates