It’s hard to imagine now, but Amazon used to be nothing more than an online bookstore.

That was back in 1994. Since then, Amazon has started selling DVDs, clothes, furniture, and just about everything else you can imagine.

They do more than just sell stuff online now, too. Amazon has become a big player in the cloud computing, video streaming, and film production industries.

Surely you’ve already heard about their latest move. On June 16, Amazon announced that they were buying every hipster’s favorite grocery chain, Whole Foods, for $13.7 billion.

This acquisition has huge implications for not just the food delivery industry, but the delivery industry in general.

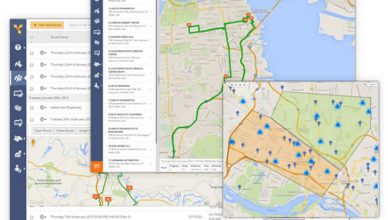

Want To See For Yourself How Route4Me Can Boost Your Profits?

What’s More Valuable: Grocery Stores Or Distribution Hubs?

Amazon has been in the food delivery game for a couple years now with AmazonFresh. So, buying Whole Foods seems on the service to be mostly about gaining a bigger share of the grocery market.

That makes sense. After all, online grocery sales topped $20 billion in 2016, and that figure is expected to hit $100 billion by 2025. There’s a lot of money to be made here.

But Amazon rarely moves in a straightforward way. They’re strategic thinkers, chess players. They plan ahead.

Amazon has been able to convince people to pay for its Amazon Prime service by offering free two-day shipping to subscribers. That offer will be harder to fulfill as more and more people sign up.

Whole Foods has over 460 stores worldwide. These stores now belong to Amazon, and Amazon can use these physical spaces as distribution centers for deliveries.

These locations offer quality in addition to quantity. Whole Foods isn’t Walmart. It’s a high-end store with high prices to match, so they’re generally located in affluent areas where residents have disposable income to throw around.

That demographic – high income, urban residence – is more likely to sign up for Amazon Prime than most. By snatching up Whole Foods and hundreds of centrally-located stores, Amazon has improved its physical infrastructure significantly. Delivering orders within one to two days will be much easier for them, even as they continue to grow.

Courier companies everywhere need to watch out. Amazon is coming.

It can be difficult to turn a decent profit with all this competition. To thrive, you’ll need to make your business more efficient with high-tech tools like route planning and GPS tracking software.

Do you have any questions about the current state of the delivery industry? Feel free to let us know in the comments section below.